to read My most recent articles, click►►

Go directly to: Money software download links

- How to record U.S. Treasury bill transactions

- How to record Equity or Index Call Options / Rights Offerings

- How to record RMD annuity withdrawals from your Traditional IRA account (& your monthly Social Security annuity payments)

- How to record stock splits, mergers and spinoffs

- How to record ✰ U.S. GOVT Series I Savings Bond transactions (also Series EE)

- How to record: Primary & Secondary (brokered) CDs, Accrued interest, Amortized Bond Premium (ABP) adjustments & Early Withdrawal Penalties

- How to record Roth IRA Conversions

- Improving Money’s handling of Investment Account Earnings

- How to setup Money for retirement income

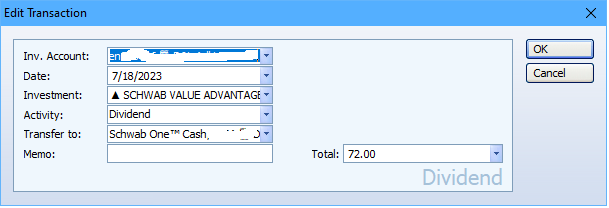

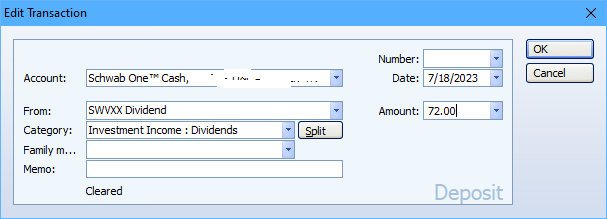

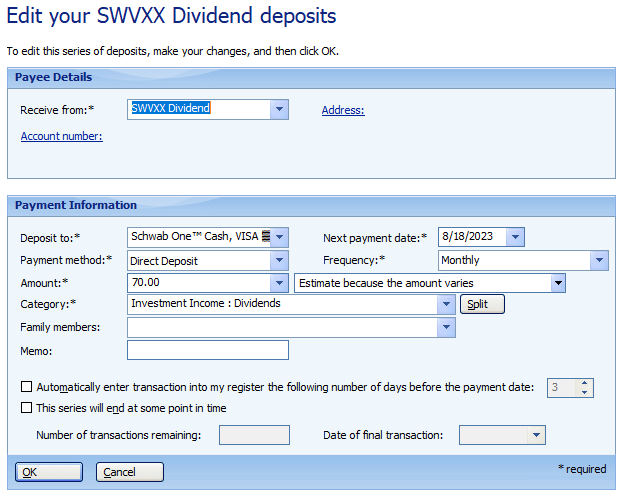

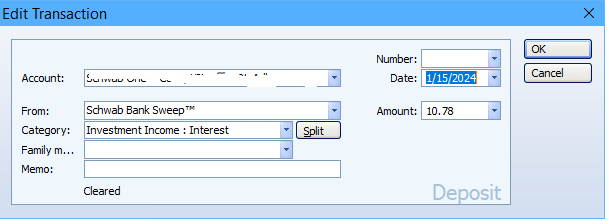

- Improving Money’s handling of monthly Money Market Earnings in your Schwab Investment Accounts

Microsoft discontinued sales of the software on June 30, 2009 and removed access to online services for existing Money installations in January 2011. If you agree with me that Microsoft Money is still the BEST personal (and small business) financial management PC software ever, then you’ve come to the right place for improving Money’s OFFLINE capabilities.

Even though Microsoft has elected to divorce the program from the MSN Money servers as of January 31st, 2011 (which did much more than just grab statement downloads, including independent stock and fund quotes for ALL of your investments, passing through third-party web-scrapes of your data, supporting Online banking, investment news, tax and exchange rates, LiveID password authentication, etc.), they have made available a **FREE** legal copy (the SUNSET edition) of the latest updated OFFLINE version of Microsoft Money Plus Deluxe that you can download, even if you’ve never used Money before! It has been preconfigured with no need to activate the product. On its own, Money will only update via OFX statement files that you download through the websites of your financial institutions.

Even though Microsoft has elected to divorce the program from the MSN Money servers as of January 31st, 2011 (which did much more than just grab statement downloads, including independent stock and fund quotes for ALL of your investments, passing through third-party web-scrapes of your data, supporting Online banking, investment news, tax and exchange rates, LiveID password authentication, etc.), they have made available a **FREE** legal copy (the SUNSET edition) of the latest updated OFFLINE version of Microsoft Money Plus Deluxe that you can download, even if you’ve never used Money before! It has been preconfigured with no need to activate the product. On its own, Money will only update via OFX statement files that you download through the websites of your financial institutions. Now by installing the latest version of the Active State Python 2.7 (not 3) and Robert’s PocketSense script package that runs on this Python package, you will be able to essentially mimic many of the online functions that Microsoft is no longer providing, although in 2022, Intuit’s Quicken monopoly has convinced several banks/brokerages/credit card companies to no longer provide free data via their OFX servers

Now by installing the latest version of the Active State Python 2.7 (not 3) and Robert’s PocketSense script package that runs on this Python package, you will be able to essentially mimic many of the online functions that Microsoft is no longer providing, although in 2022, Intuit’s Quicken monopoly has convinced several banks/brokerages/credit card companies to no longer provide free data via their OFX servers  .

. Another new program, written by a former Microsoft Money programmer, that will update all of your investment quotes in a very similar fashion to Money’s original online updater through MSN, is available for a nominal one-time fee. It is called MSMoneyQuotes and you’ll find links to it in this blog post.

Another new program, written by a former Microsoft Money programmer, that will update all of your investment quotes in a very similar fashion to Money’s original online updater through MSN, is available for a nominal one-time fee. It is called MSMoneyQuotes and you’ll find links to it in this blog post. For those that only need to update quotes (no Account Statement updates) and don’t wish to install Python scripting, Hung Le had written a Java app a year ago that has been recently updated and the link in the original Blog page has been updated with this new version.

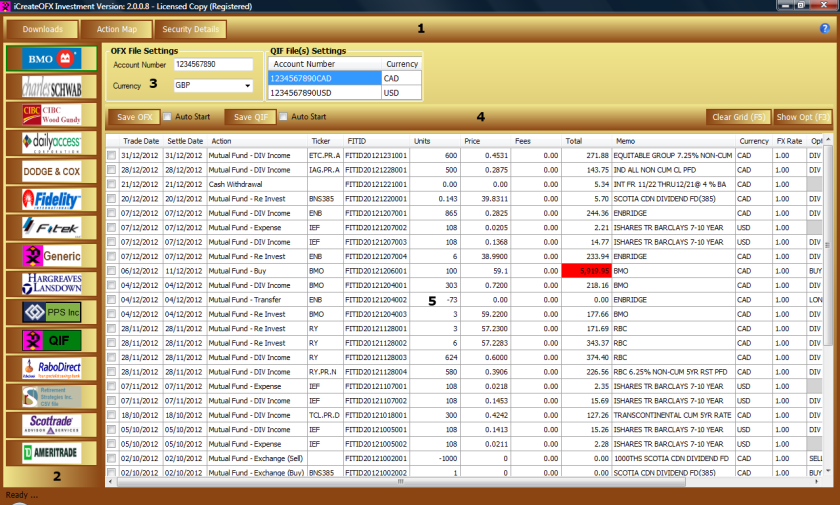

For those that only need to update quotes (no Account Statement updates) and don’t wish to install Python scripting, Hung Le had written a Java app a year ago that has been recently updated and the link in the original Blog page has been updated with this new version. I have developed Ameridan’s addon package to PocketSense that allows you to run these scripts (and review your Online investment data) from within your Money program.

I have developed Ameridan’s addon package to PocketSense that allows you to run these scripts (and review your Online investment data) from within your Money program.

>>>>> PocketSense Sites.dat Blog page <<<<<

♦♦♦♦

Also, make sure you check out the

Look Up Your OFX Settings

portal page, with links to all of the other sources of OFX settings

that I am currently aware of

NOTES:

1. If any Money Plus, 2007, or 2006 users use a Live ID (email address plus password), they should remove that with File-> Password Manager. This can only be done if they can get into the Money file. They should then use a local “Money password” only (if they want a password at all). Money 2005 users don’t have this ability, and must continue to log in offline.

2. Do not attempt to reset your Live ID ,as the program may suggest. Any attempt to do so will be ineffective. Only the credentials in effect at the time that you last successfully got in to your Money file will work.

3. You should use Windows Firewall to cut Money off from the internet, so that it doesn’t work so hard trying to access servers that no longer exist. This is a speed and convenience issue. See my article “Eliminating the “online updating”delays and errors when opening Money” for details.

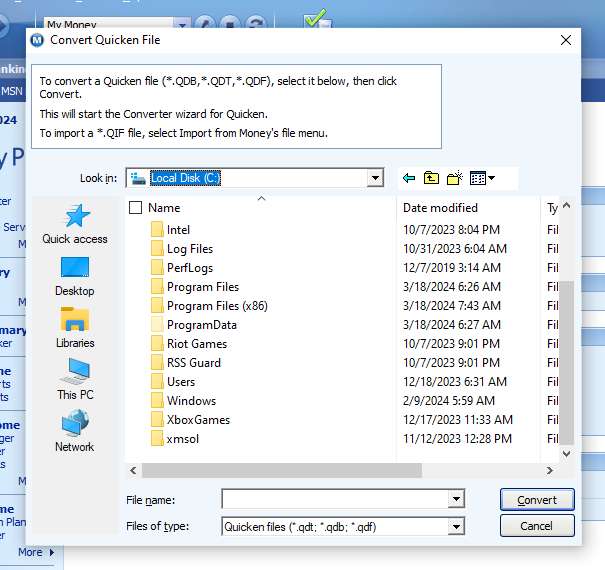

4. Anyone switching over from older versions of Quicken should know that Microsoft’s converter wizard may significantly simplify the process. File > Convert Quicken File 5. Customize your Money’s Home Page such that the only two modules are Reminders and Favorite Accounts (Advisor FYI is OK to display, as well). Other modules like Bills & Deposits and Investment Performance can consume some time and prevent you from working with your file right away (and have even been known to occasionally cause the program to exit).

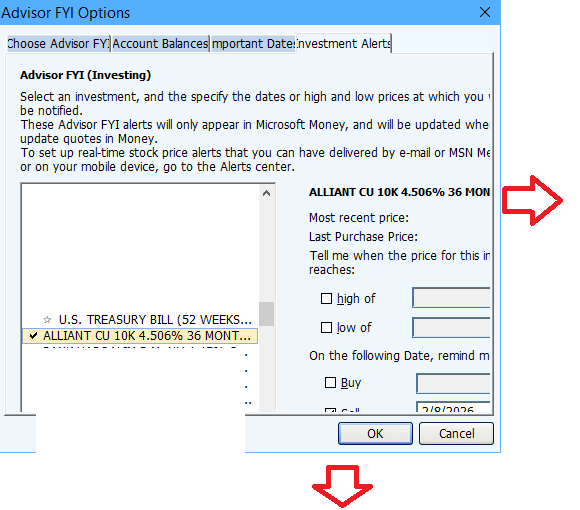

5. Customize your Money’s Home Page such that the only two modules are Reminders and Favorite Accounts (Advisor FYI is OK to display, as well). Other modules like Bills & Deposits and Investment Performance can consume some time and prevent you from working with your file right away (and have even been known to occasionally cause the program to exit).

6. There is a small bug in the Home & Business version, whereby the income category assigned to your products/services may become disassociated. It is discussed further in my article.

(a good portion of the following, is courtesy of Cal Learner, our Money MVP)

Download links

Additional details and patches are available at http://moneymvps.org/

Self-contained installation files for use (including if the original disk requires activation). No direct online access works with the Sunset versions, which have been revised to be OFFLINE (access to MSN servers has been deactivated).

Notes for North America:

1. US and Canadian Money 2005 and Essentials users — as well as other US and usually Canadian users — can use Money Plus Deluxe Sunset if they have to reinstall at some point.

2. Some US users of older versions of Money (Money 98 through Money 2003) may have to use an additional step, by first installing a version of US Money 2004 (see “Trial edition of Money 2004” link below) or 2005 to perform a file conversion before installing Money Plus Sunset.

US Money Plus Deluxe Sunset (works with US and Canadian Files only)

>> download here (only click on the download button showing the file’s size)

US Money Plus Home and Business Sunset (works with US and Canadian Files only; link fixed 1/15/2023)

>> download here (only click on the download button showing the file’s size)

Money 2005 UK – QFE2

Self-contained UK Money 2005 file including all available patches. Replaces all MS Money UK 2005 installation discs. Usually solves “Money cannot locate the file because it’s a read only file or you do not have permission to change it” error message.

>> download from: http://moneymvps.org/downloads/files/2005/Money2005-UK-QFE2.exe by clicking on said url in your browser, and then the Enter key.

Money 2005 International English QFE2

Self-contained Money 2005 International English installation file from Microsoft, including all updates (For Australia, New Zealand, Hong Kong and all other English versions other than for US, Canada, UK).

>> download from: http://moneymvps.org/downloads/files/2005/Money2005-IntlEngl-QFE2.exe by clicking on said url in your browser, and then the Enter key.

Money 2005 French – QFE3

Self-contained French Money 2005 file including all available patches. Replaces all MS Money French 2005 installation disks.

>> download from: http://moneymvps.org/downloads/files/2005/Money2005-FR-QFE3.exe by clicking on said url in your browser, and then the Enter key.

More…

It is suggested that all Money users keep a good copy of the installation file, even if the need is not immediate. It will be needed if you reinstall Money in the future. Those links can change, so do a search if you don’t find the file you need. Since we don’t know how long these files will be available, it is best to keep a copy of your appropriate installation file in a safe place.

Patch needed for newer versions of Money running on Windows 10 & 11

Because of a bug in the file mnyob99.dll, there are issues with Windows 10 & 11. It is recommended that a patched version of this file be used to resolve these issues and insure compatibility. Read more (and find links to the patch) here.

Regional versions

Money data files are in a different format for each region. The correct regional version of Money must be used or the data file will not open.

It is possible to convert from one region to another only by exporting data as loose qif and importing to the new regional version of Money.

Old Money versions will run only under 32-bit Windows

Old versions (Money 2000 and earlier) include 16-bit code so they can only run under 32-bit Windows (XP, Vista, 7 and 8).

To be able to use data files from these older versions on a 64-bit PC with Sunset Money:

- Download m12usweb.exe (Trial edition of Money 2004) to the new computer.

(MD5 is 1c62413858e2184eb39862f1b2afba44) - Put the latest *.mny and *.mbf files into the Documents folder of the new computer

- Temporarily uninstall Sunset if you had already installed on new computer

- Disconnect from the Internet (may not be needed, but recommended)

- Set the computer date to 2004/1/1 (or there about)

- Install trial Money 2004 by running m12usweb.exe

- Let that convert your *.mny file. Check that it seems to work. Save the converted file. Maybe change the name so that you can distinguish the converted file. Close Money 2004

- Set the date right. Install/reinstall Money Plus Sunset. Let it uninstall Money 2004.

- Install the patch mentioned in red ⇑ above.

- Let Sunset convert the Money 2004 *.mbf file to Sunset

- Make extra copies of Sunset install, patch and data files onto other media

64-bit Windows

The U.S. Sunset versions of Money, downloadable above, run great in Win32 mode of Windows 8, 10 & 11. They are not 64-bit programs though, so hopefully, Win32 remains supported within Windows for many years yet.

Specific to Windows 10 & 11, due to a sloppy coding entry in Money’s installation routine, an inconsequential “glitch” of Sunset versions has been noted. After installation, if you go into Windows settings, in the Apps > Installed apps window in Windows 11, the value for the installed size of Microsoft Money Plus is listed incorrectly as GB instead of MB, (something huge, 101 GB or similar). This causes no issues by itself, but to correct the listed value to its actual size, you can change a single registry value (thanks Russell Sullivan):

-

- Open the Registry Editor (searching for Registry Editor in the search box after selecting the Windows Start menu button, and opening the program.)

- Navigate to the following, depending upon your version of Windows (64-bit or 32-bit): 64-bit Windows versions: HKEY_LOCAL_MACHINE\SOFTWARE\WOW6432Node\Microsoft\Windows\CurrentVersion\Uninstall\Money2008b or 32-bit Windows versions: HKEY_LOCAL_MACHINE\SOFTWARE\Microsoft\Windows\CurrentVersion\Uninstall\Money2008b

- In the right side of the registry editor window, find and select the “EstimatedSize” key REG_DWORD value.

- Right-click, select Modify… from the context menu, then an “Edit DWORD (32-bit) Value” window will open.

- Click on the radio button to change the base value from Hexadecimal to Decimal.

- In the Value Data box, look at the number displayed (105603072 or similar for a decimal value). Divide that number by 1024, then replace the number in the value data box with that new smaller number, which might be 103128 (or similar).

- Click on OK, then close the Registry Editor.

Internet Explorer

According to DominicP, Money Sunset and QFE2 versions do not actually need IE to be installed, as they actually incorporate their own, limited-capability IE browser which serves as the GUI.However, residual code still exists in the install executable which checks the registry for the presence of IE and its build number so therefore, I am concerned that if Microsoft ever removes the legacy Trident (also known as MSHTML) proprietary browser engine (mshtml.dll) and associated IE registry entries, installation / reinstallation of Money may cease to function, which is the primary reason why I have turned off Windows 10/11 automatic (and manual) updates, although I do intend to periodically catch-up with stable versions that remain Money-friendly.

Multiple Monitors

Money does not play well with multiple monitors, especially if one is disconnected at a later time, as might be the case with a laptop attached to other display(s) at work. If you find Money not behaving properly (ie not appearing after engaging program, customize reports dialogue box disappearing, etc.), open sample.mny while the multiple monitors are hooked up, and insure that Money is closed in full-screen mode – and only on the primary (default) monitor.

Another alternative method that should also work:

| Windows logo key |

Task View, allowing you to select hidden program and make it active. |

| Windows logo key |

Moves the active app on the desktop from one monitor to another. |

Kevin N offered this alternative to James D, who claimed that Money “froze” when trying to customize reports (James later confirmed that this did indeed resolve his issue):

- Call up the ‘Customize Report’ window. MS Money will appear to have frozen.

- Use key-combo ALT-SPACEBAR. A small context menu may or may not appear at the edge of the monitor.

- Tap the letter ‘m’ on your keyboard so as to invoke the “Move’ command.

- Hold down the appropriate ARROW key, likely the LEFT ARROW key so as to hopefully move the orphaned window back on-screen.

Hi-Def Monitors

Money also may not display text/data properly on Hi-Def monitors, until the “High DPI scaling behavior” is altered (thank you TWG for sharing):

- Open Start menu, right click on the Money Plus icon ➜ more ➜ left click “file location“.

- In the newly opened “ProgramData > Microsoft > Windows > Programs > Microsoft Money Plus” folder right click the Money shortcut ➜ then left click “Properties“.

- Left click on the “Compatibility” tab.

- Three quarters down the page is a “Change high DPI settings” button. Left click it.

- Near the bottom of the page is the “High DPI scaling override” section. Select the “High DPI scaling behavior” check box.

- Select “System Enhanced” from the option menu below the check box.

- Click on OK twice as you back out of the menus.

- Open Money, to see if the changes improve Money’s display, if not, unwind the changes.

To enlarge a good portion of the displayed text on Money’s GUI screens, Sean Dayton offers this advice:

To enlarge a good portion of the displayed text on Money’s GUI screens, Sean Dayton offers this advice:

“What I have done to make MS Money more visible to read on a 27 inch 1080P monitor is to modify the the Surf.Mar file, which can be found in:

%ProgramFiles(x86)%\Microsoft Money Plus\MNYCoreFiles

→→for 64-bit Windows , OR

%ProgramFiles%\Microsoft Money Plus\MNYCoreFiles

→→for 32-bit Windows)”

Since the MNYCoreFiles folder has Read-only attributes, drag the file(s) you’re going to edit onto your desktop, make your changes with a text editor like notepad++, Save, and then Copy/Paste back to the folder (along with any newly created .bak file(s); admin privileges needed) once you are finished.

Search for, and change the following:

Search for: font13 , font-family:Tahoma; font-weight:normal; font-size:7pt Suggested change ==> font-size:9pt ----------------

Search for: fontnormal , font-family: Tahoma;font-size:8pt Suggested change ==> font-size:9pt

Money version downloads

Up until 2/1/2021, Microsoft made available (for free), the latest Sunset versions of Microsoft Money, but without support. Once those links were no longer valid, I uploaded my saved copies, and updated the links for my readers.

Whichever version you settle on, I encourage you to keep a secure copy of your downloaded installation file, since your data will be inaccessible should your Money program ever become corrupted (or if you procure a new PC), and you find yourself unable to reinstall the same version of Money that corresponds with your data file.

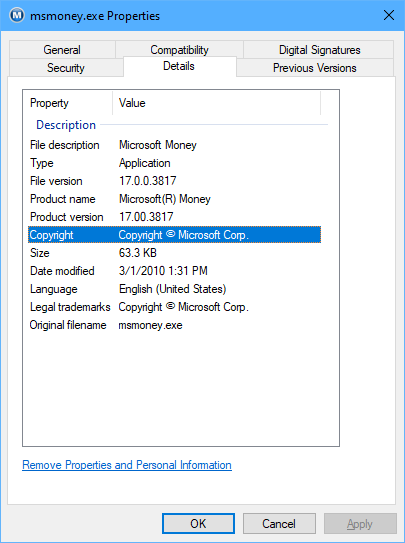

Determining what version of Money you have installed

If you are able to run Money, select Help, and then select About Money. An alternative method…

C:\Program Files (x86)\Microsoft Money Plus\MNYCoreFiles\msmoney.exe

Right-click on the file ⇑ and select Properties. Product name and version will be revealed after you select the Details tab…

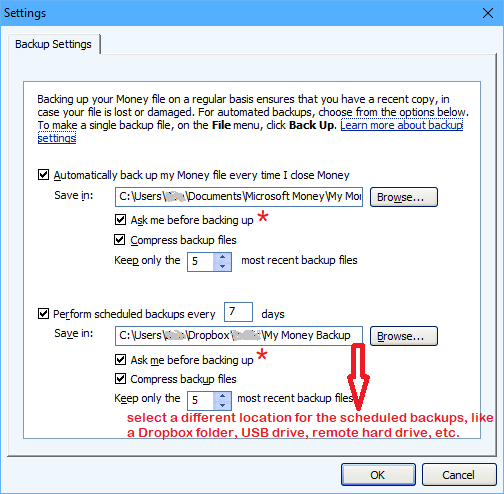

Backup file strategy

Cal reminds us: Money 2005 overwrites the previous backup by default. Consider that if a file gets corrupted, backing up will back up the corrupted version, overwriting the previous good backup. So consider establishing a procedure to keep more than one vintage of backups.

For newer versions of Money, simply consider this strategy…

* The reason for having Money prompt you, is so that you don’t create a back up file each time you exit (which also overwrites the oldest backup file). If I went into Money 10 times in a day, I would not want to back up 10 times, nor would I want to delete every known good backup file from previous days. You will be given the choice to Back-Up Now or to Postpone.

Backup file versions

(from my C:\Program Files (x86)\Microsoft Money Plus\MNYCoreFiles\Setup\mny.inf file)

; File Associations

FILE_TYPE_MNY = "Microsoft Money file"

FILE_TYPE_MNE = "Microsoft Money Essentials file"

FILE_TYPE_MBF = "Microsoft Money backup file"

FILE_TYPE_EV16 = "Microsoft Money Essentials backup."

FILE_TYPE_V17 = "Microsoft Money Plus (& "Sunset") backup." .m17

FILE_TYPE_V16 = "Microsoft Money 2007 backup." .m16

FILE_TYPE_V15 = "Microsoft Money 2006 backup." .m15

FILE_TYPE_V14 = "Microsoft Money 2005 backup." .m14

FILE_TYPE_V12 = "Microsoft Money 2004 backup." .m12

FILE_TYPE_V11 = "Microsoft Money 2003 backup." .m11

FILE_TYPE_V10 = "Microsoft Money 2002 backup." .m10

FILE_TYPE_V9 = "Microsoft Money 2001 backup." .mn9

FILE_TYPE_V8 = "Microsoft Money 2000 backup." .mn8

FILE_TYPE_V7 = "Microsoft Money '99 backup." .mn7

FILE_TYPE_V6 = "Microsoft Money '98 backup." .mn6

FILE_TYPE_V5 = "Microsoft Money '97 backup." .mn5

FILE_TYPE_V4 = "Microsoft Money '95 backup." .mn4

FILE_TYPE_V3 = "Microsoft Money v3 backup." .mn3

FILE_TYPE_V2 = "Microsoft Money v2 backup." .mn2

FILE_TYPE_V1 = "Microsoft Money v1 backup." .mn1

PocketSense AppID and AppVER:

| Product Version | APPID | APPVER |

| Money Plus (aka Money 2008) & Money Plus – “Sunset” (aka Money 2009) |

Money Plus | 1700 |

| Money 2007 | Money | 1600 |

| Money 2006 | Money | 1500 |

| Money 2005 | Money | 1400 |

| Money 2004 | Money | 1200 |

| Money 2003 | Money | 1100* |

| Money 2002 | Money | 1000* |

| Money 2001 | Money | 900* |

| Money 2000 | Money | 800* |

| Money 99 | Money | 700* |

| Money 98 | Money | 600* |

| Money 97 | Money | 500* |

* PocketSense scripts are not compatible with these versions (and possibly Money 2004)

Release History (source):

| Marketed version | Release Date | Actual version | Notes |

|---|---|---|---|

| Microsoft Money | October 2, 1991 | 1.0 | Initial release for Windows 3.0. |

| Microsoft Money 2.0 | September 9, 1992 | 2.0 | |

| Microsoft Money 3.0 | January 6, 1994 | 3.0 | Final Win16 version. |

| Microsoft Money 95 | August 24, 1995 | 4.0, 4.0a | First Win32 version. |

| Microsoft Money 97 | November 19, 1996 | 5.0 | Added ability to close accounts, provided online banking capabilities including online stock quotes (supported until February, 2004), and contained minor UI improvements. Last version to support Windows NT 3.51. |

| Microsoft Money 98 | October 30, 1997 | 6.0 | First version to require Internet Explorer as part of the interface. |

| Microsoft Money 99 | August 14, 1998 | 7.0 | Last localized release for Germany and Brazil. |

| Microsoft Money 2000 | July 30, 1999 | 8.0 | First edition for Windows Mobile platforms. Last localized release for Italy and in German Language for Switzerland and Austria. |

| Microsoft Money 2001 | September 7, 2000 | 9.0 | |

| Microsoft Money 2002 | August 16, 2001 | 10.0 | Last version to support Windows 95 and Windows NT 4.0 SP5. |

| Microsoft Money 2003 | October 24, 2002 | 11.0 | |

| Microsoft Money 2004 | August 29, 2003 | 12.0 | Last version to support original version of Windows 98 (“First Edition”). |

| Microsoft Money 2005 | October 21, 2004 | 14.0 | Last localized release for the U.K., French, and the International edition. |

| Microsoft Money 2006 | September 27, 2005 | 15.0 | Last localized release for Canada. Last version for Windows 98 SE/ME, and Windows 2000 SP3. Also the last version for Windows Mobile platforms. |

| Microsoft Money 2007 | August 19, 2006 | 16.0 | First version to require product activation for copies installed from downloaded installation files. |

| Microsoft Money Plus | December 6, 2007 | 17.0.150.1415 (Home & Business)

17.0.120.1415 (Deluxe) 17.0.80.1415 (Essentials) |

Final retail release. First and only version to require product activation when installed from CD. |

| Microsoft Money Plus “Sunset” | March 18, 2010 |

17.0.150.3817 (Home & Business) 17.0.120.3817 (Deluxe) |

Removed the activation requirement and most of the online updating features. |